Understanding Credit Memos

What is a Credit Memo?

A Deep Dive for EasyEviction Users

A Credit Memo is used to reimburse clients for invoices that have been overpaid. Once issued, the credit balance can be applied to future invoices. Clients can view their available Credit Memo balance.

This article will explain when and how to create a Credit Memo, how to view your client’s Credit Balance, and how to apply Credit Memo to other invoices. Let’s dive into this essential invoicing tool.

When is a Credit Memo Appropriate?

A Credit Memo is essentially a document that serves as an adjustment to an original invoice. It’s often issued when an error has been made in billing, and it can either reduce the amount owed or create a credit balance for future use.

Here’s why and when you would create a Credit Memo:

- Overpayment or overcharge: The client paid more than what was due.

- Incorrect services billed: You billed for something that wasn’t delivered or was priced incorrectly.

- Discount adjustments: A discount or special pricing wasn't applied correctly.

- Returns or cancellations: If the service was returned or canceled after the invoice was issued.

By issuing a Credit Memo, you ensure the client is properly credited for the overcharge or adjustment.

How to Create a Credit Memo in EasyEviction

Creating a Credit Memo in EasyEviction is straightforward and it can be done in just a few steps. Here’s how:

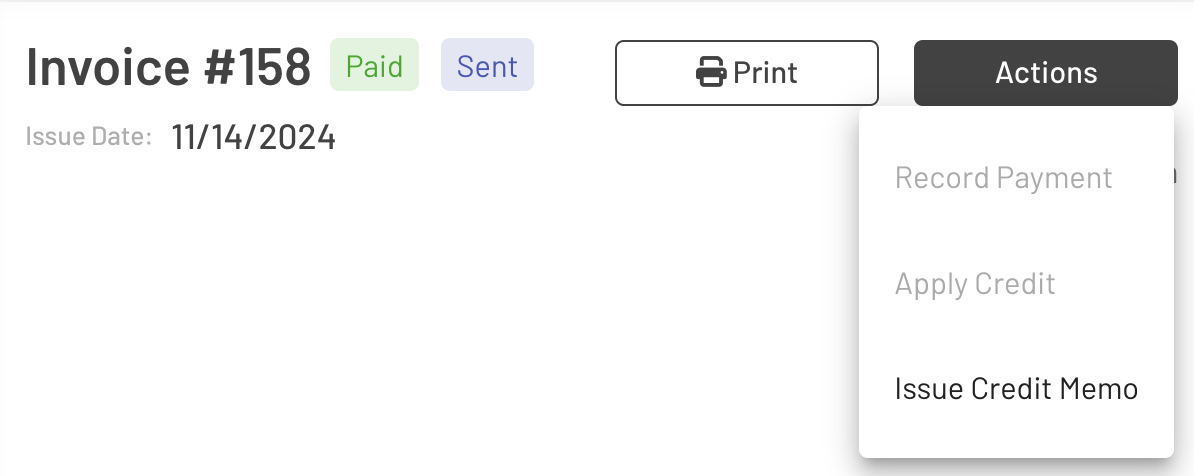

Go to the Invoice Details Page: Start by locating the invoice for which you need to create a Credit Memo. This is typically an existing, paid invoice already sent to the client. Next, click Issue Credit Memo from the Actions menu.

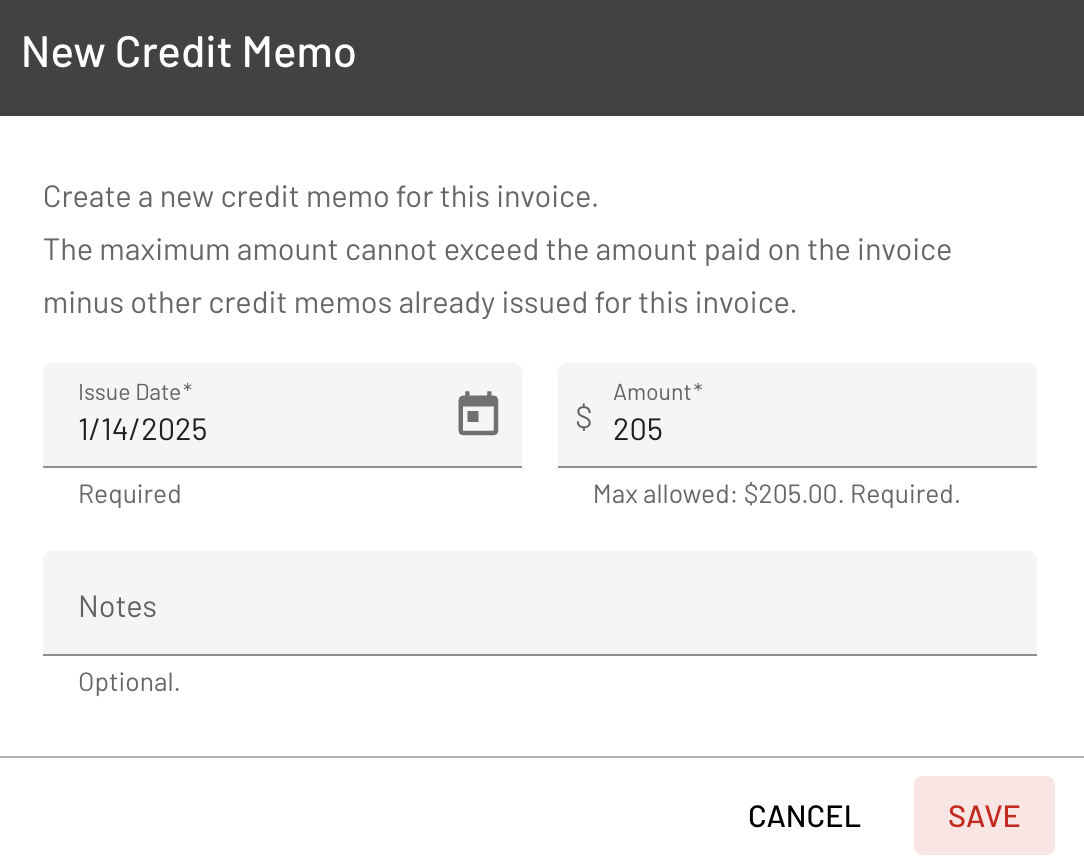

Create the Credit Memo:

Enter the amount to be credited. This can be a partial amount or the full invoice amount, depending on the adjustment needed. You may add any necessary notes for clarification (e.g., "Overcharge" or "Return").

Confirm and Save: Once you've reviewed the details, confirm and save the Credit Memo. Any saved adjustments will automatically appear in the Credit Memos section on the right-hand pane of the Invoice Details page.

To learn more about Invoice Adjustments—including applying Credit Memos, Write-Offs, and Credits, click here.

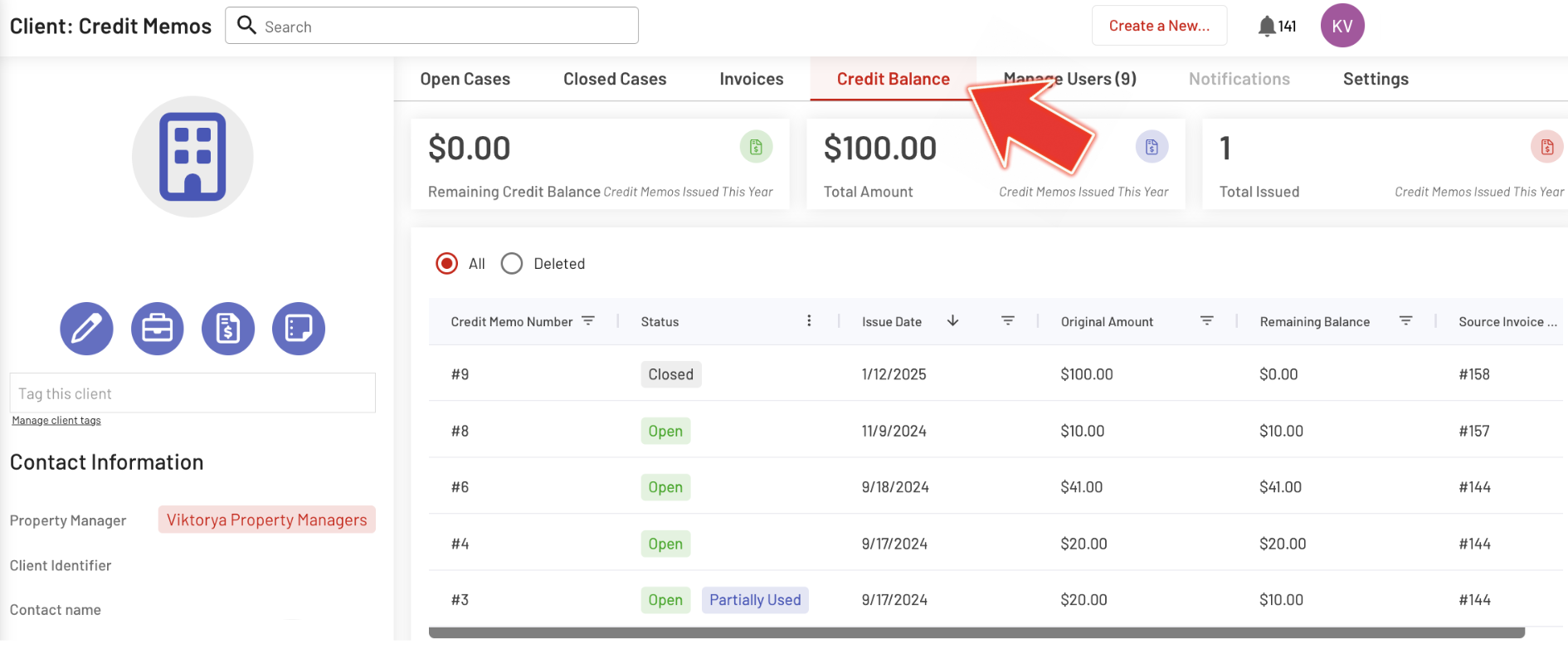

How to View a Client’s Credit Balance

After issuing a Credit Memo, you can track how much credit is available for a specific client.

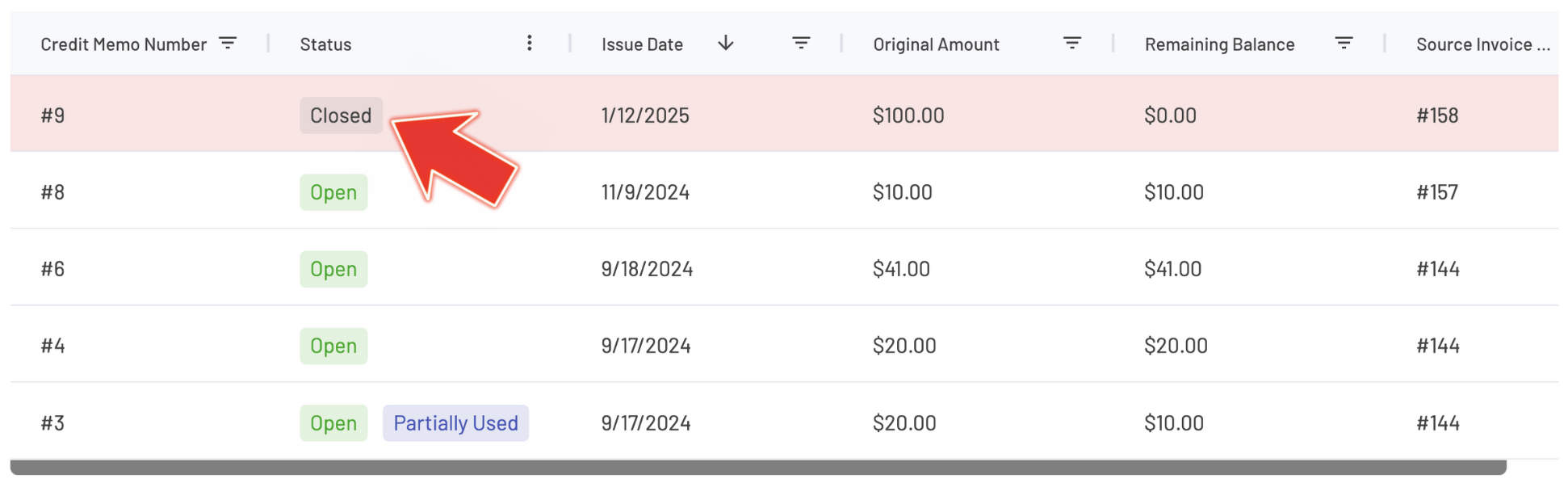

Go to Clients, select a specific client, and then click on the Credit Balance tab.

This lets you easily monitor and manage the client's available credit for future transactions. To view the details of a specific Credit Memo, click the corresponding credit from the list.

How to Apply a Credit Memo to Other Invoices

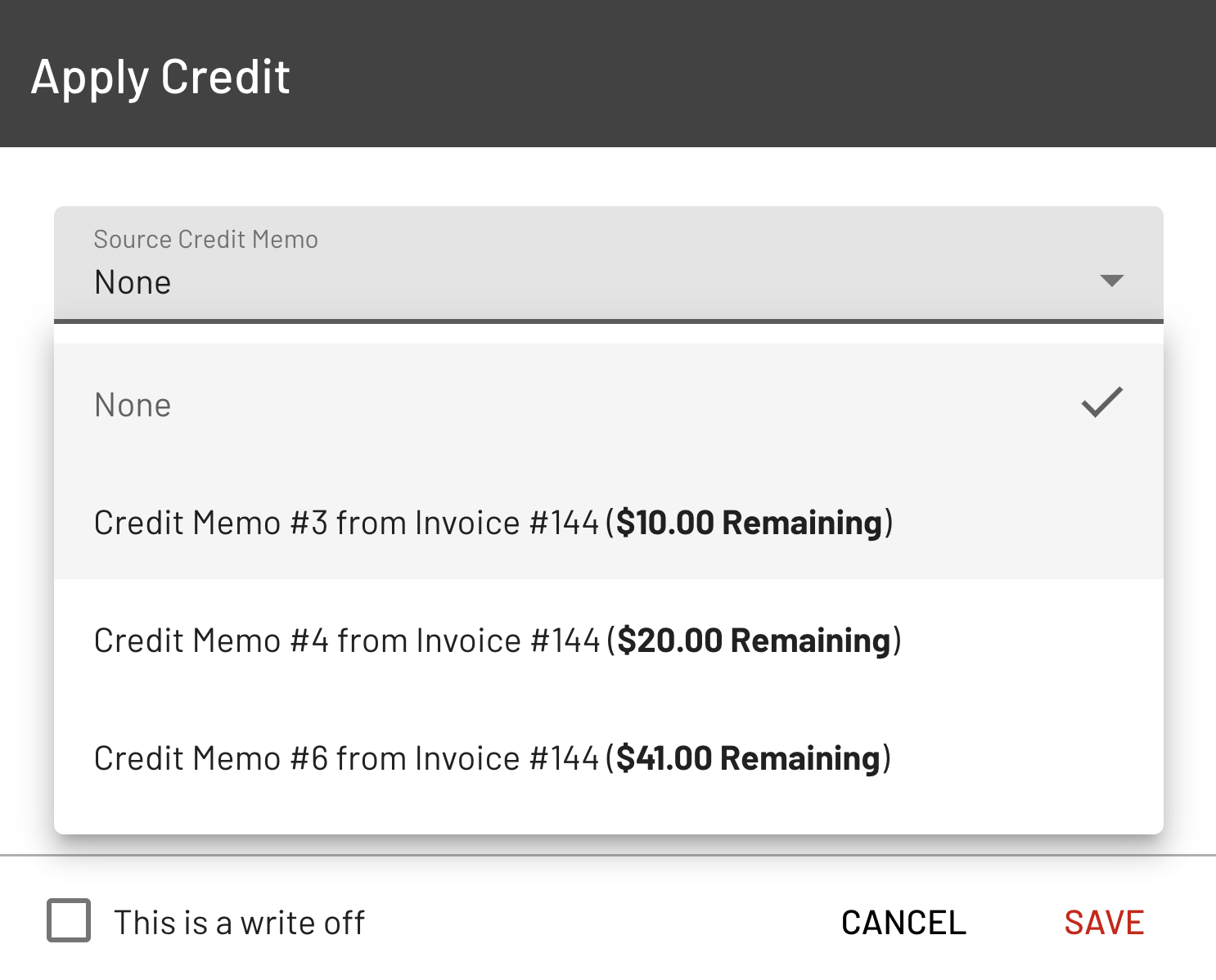

One of the most important features of a Credit Memo is the ability to apply it to other invoices. It’s important to note that a Credit Memo cannot be applied to the same invoice from which it originated.

Here’s how to apply a Credit Memo to a new invoice:

Go to Invoices, select a specific invoice, and click "Apply Credit" from the Actions Menu. Choose Source Credit Memo, then select the particular Credit Memo you wish to apply from the list. Finally, enter the amount to be deducted from the Credit Balance.

Save the Changes: After the Credit Memo has been applied, save the updated invoice. The credit will be reflected in the invoice, and the client will see the adjusted balance.

What Happens When the Balance on a Credit Memo is Used Up?

Once a Credit Memo is fully applied to invoices, it is considered used up, and its status will change from open to closed.

And that's it! This is how a Credit Memo works: once applied, its balance can be used to offset a specific invoice. This process allows you to effectively manage overpayments and apply the credit to future invoices.

If you need further assistance, feel free to reach out to our support team.